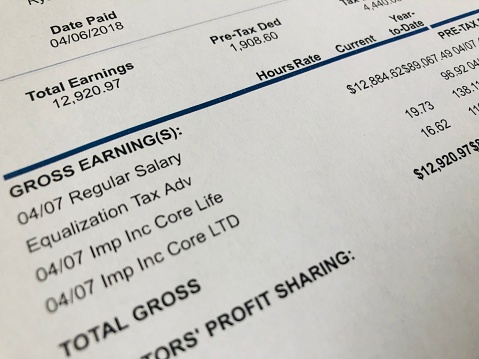

What is Paystub?

A paystub is an important part of an employee’s paycheck that outlines the amount of money they have earned for the current pay period, as well as the year-to-date total. The paystub also includes details of deductions, such as employee tax withholdings, benefits, and other deductions, as well as employer contributions. The paystub will show the employee’s net salary, that is, the amount he will receive after deductions. In addition, the payroll will provide information such as hours worked, dates of pay periods, and up-to-date employee information. Maps make it easy to keep track of all these details throughout the year.

Pay Stubs are an important part of the payroll processes, serving as a record of the agreed-upon compensation between employers and employees. While there is no federal mandate requiring pay stubs, they provide benefits for both businesses and employees. Without generating pay stubs for employees each pay period, businesses risk damaging their relationship with their employees and potentially putting their business in jeopardy. Here are 13 reasons why businesses should make pay stubs for their employees:

-

To Keep Track of Your Earnings:

A paystub is a great way to keep track of your earnings throughout the year. It provides a detailed record of your income, deductions, and taxes that have been withheld from your paycheck. This can be a useful tool for budgeting and tracking your finances.

-

To confirm your income:

Paystubs can also be used to verify your income when applying for credit or other financial services. This is especially important if you are self-employed or have multiple sources of income.

-

To check accuracy:

Pay stubs can help you make sure your employer is calculating your pay accurately and withholding the correct amount of tax. This is especially important if you are paid hourly or have multiple sources of income.

-

To track benefits:

Pay slips can also be used to track your benefits, such as vacation or sick time. This can help you stay organized and ensure you take advantage of all the benefits your employer offers.

-

To track your taxes:

Payment receipts can also be used to track taxes throughout the year and ensure you know exactly which of the income tax brackets 2024 applies to your financial situation. This can help you make sure you file your tax return accurately and that you don’t pay more than you should.

-

To get a loan:

Pay stubs can be used to get credit if you want to apply for a loan or other financial services. This is especially important if you are self-employed or have multiple sources of income.

-

To receive a tax refund:

Payment tickets can also be used to claim tax refunds. This is especially important if you are self-employed or have multiple sources of income.

-

To apply for unemployment:

Payment receipts can also be used to apply for unemployment benefits.

-

To receive social security benefits:

Payment tickets can also be used to receive social security benefits.

-

To track your retirement savings:

Maps can also be used to track your retirement savings. This is especially important if you are self-employed or have multiple sources of income.

-

To Get Pay Stubs from Direct Deposit:

If you are wondering how to get Paystubs from direct deposit, then let me help. This is especially important if you are self-employed or have multiple sources of income. If you receive your paycheck through direct deposit, you may be wondering how to get pay stubs. Pay Stubs are important documents that provide a record of your earnings and deductions. Fortunately, getting paystubs from direct deposit is easy.

The first step is to contact your employer and ask them how they provide pay stubs. Many employers offer pay stubs online, so you may be able to access them through an online portal. If your employer offers online paystubs, they will provide you with a username and password to access them.

If your employer doesn’t offer paid receipts online, you can ask them to provide you with paper copies. Your employer should be able to give you a copy of your payslip every time you get paid.

You can also contact your bank if you have questions about direct deposit payment receipts. Your bank can provide you with a copy of your payment receipt or they can provide you with information on how to access them.

Finally, you can also access your payment accounts through the Internal Revenue Service (IRS). The IRS can provide you with a copy of your payment statement if you request it.

Getting payouts from direct deposit is easy. All you need to do is contact your employer or bank to find out how to access them. Once you have the information you need, you can easily access your payslips and keep track of your earnings and deductions.

-

To Make Sure You Receive Your Wages on Time:

Paystubs can also be used to make sure you receive your wages on time.

-

To Keep Track of Your Hours Worked:

Billing information can also be used to track hours worked. This is especially important if you are paid hourly or have multiple sources of income.

Final Say

Electronic pay stubs are incredibly beneficial for businesses. Not only do they help to reduce expenses, they also free up office space by eliminating the need for filing cabinets. Online pay stub generators such as The Best Pay Stubs Maker make the process of creating pay stubs simpler and faster while streamlining the operations of your business.

Pay stubs are important documents for both employers and employees. Employees use them to verify that they are getting paid correctly and to track deductions. Employers can use pay stubs to review and resolve any issues related to employee pay.